Unlocking the Truth: Is State Life Insurance Halal or Haram?

In today’s dynamic financial landscape, many Muslims ask, Is state life insurance halal or haram? This question is crucial for those who want to align their financial decisions with their Islamic values while ensuring the protection of their families. With the rise of Sharia-compliant financial products such as the Golden Endowment insurance plan, understanding the nuances of state life insurance becomes essential.

Understanding the Basics of Life Insurance in Islam

State life insurance is essentially a contract between the state-run insurance corporation and policyholders, where regular premium payments promise a future payout to the beneficiaries upon the insured’s death. In the context of Islamic finance, this arrangement raises key concerns:

- Riba (interest): Many conventional insurance products invest in interest-bearing instruments, which are not permissible in Islamic law.

- Gharar (uncertainty): The uncertainty about when and if the payout will occur, especially in term policies, can be problematic.

- Maysir (gambling): The element of speculation, where the payout depends on uncertain future events, may resemble gambling.

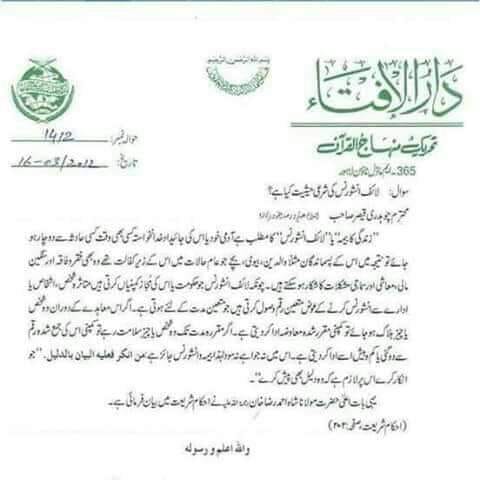

Islamic scholars, or ulma, have debated these aspects extensively. Many supportive opinions argue that if the insurance model is structured to avoid these prohibited elements, then it may fall under the category of halal. Alternatives such as the Golden Endowment insurance plan and Takaful-based products have emerged as viable solutions for those seeking Sharia-compliant options.

The Debate: Halal or Haram?

Is state life insurance halal or haram? The answer depends largely on the structure and underlying investments of the policy:

Arguments for Halal

- Mutual Cooperation and Shared Risk: Many Islamic scholars support models that are similar to Takaful, where policyholders pool resources and share the risks together. This cooperative approach is more aligned with Islamic principles.

- Guaranteed Benefits: Whole life or life assurance policies, which guarantee a payout upon death, are often viewed as more compliant if they avoid speculative elements.

- Sharia-compliant Investments: If the funds collected are invested in halal assets and avoid industries that involve interest or speculation, then it better meets Islamic standards.

Arguments for Haram

- Presence of Interest (Riba): If the state life insurance policy includes any element of interest, the policy may be deemed haram by many scholars.

- Uncertainty (Gharar) and Speculation (Maysir): Especially in term insurance plans, the uncertainty of whether there will be a payout can raise concerns regarding the presence of gharar and maysir.

- Investment of Premiums: Policies that channel premiums into non-halal ventures or contain ambiguous contractual terms may conflict with Sharia law.

The debate frequently references various ulma opinions and insights from renowned Islamic financial experts such as Sheikh Joe Bradford. Their views emphasize that the acceptability of any life insurance product often rests in the details—how the premiums are invested, whether the system is cooperative (as in Takaful), and if the product structure inherently avoids any form of riba, gharar, or maysir.

The Role of the Golden Endowment insurance plan and Other Alternatives

For many seeking clarity on Is state life insurance halal or haram?, alternatives like the Golden Endowment insurance plan offer a promising path forward. These products are carefully designed to meet Islamic ethical standards with clear features:

- Elimination of Interest: Strict avoidance of any interest-generating investments.

- Transparent Terms: Clear and unambiguous contractual language, reducing elements of uncertainty.

- Ethical Investment: Funds are channeled exclusively into Sharia-compliant sectors, promoting financial practices aligned with Islamic values.

Other alternatives include Takaful — the Islamic insurance model — which is based on mutual cooperation and shared responsibility, ensuring that policyholders are not merely customers but partners in a risk-sharing arrangement.

Final Thoughts: Making an Informed Decision

Choosing the right life insurance policy is not just about financial planning; it’s also a reflection of one’s religious commitment. When asking Is state life insurance halal or haram?, consider the following steps:

- Do your research: Examine the policy’s structure, especially looking for any elements of riba, gharar, and maysir.

- Seek advice from knowledgeable ulma: Consult with trusted Islamic scholars and experts who understand the intricacies of modern financial products.

- Consider Sharia-compliant options: Products like the Golden Endowment insurance plan or Takaful-based policies can offer a balanced solution that meets both financial and spiritual needs.

- Reflect on your financial goals: Ensure that your insurance product not only protects your family but also respects your values and beliefs.

In the end, aligning your insurance choices with Islamic values is a deeply personal decision, one that requires both careful scrutiny and sincere reflection.

Syed Manzar Abbas Kazmi is a Senior Sales Manager at State Life Insurance Corporation with over 10 years of experience in helping clients secure their financial futures through customized insurance solutions. His expertise ensures that all issues related to policy issuance or claims are resolved efficiently and effectively.

For personalized assistance or inquiries about this plan: WhatsApp Number: +923455965109

Take control of your financial future today by reaching out to Syed Manzar Abbas Kazmi!